ZKP Surges With a Live Presale Auction and Growing 7000x Buzz While SUI & XLM Struggle to Push Up

| Sponsored Post Disclaimer: This publication was produced under a paid arrangement with a third-party advertiser. It should not be relied upon as financial or investment counsel. |

Late January 2026 has seen steady participation across the crypto market, even as sectors shift rapidly. Overall capitalization remains near $3.1–$3.2 trillion, with daily trading volumes around $115 billion, showing strong liquidity. In this environment, projects with real-world applications are drawing attention more than hype-driven assets.

XLM Stellar, and SUI are under the microscope as analysts weigh broader momentum and adoption potential, while networks emphasizing practical utility, infrastructure, and sustainable growth are standing out. Investors are focusing on coins and projects that combine resilience with clear use cases, shaping which names capture market momentum.

This gap is where Zero Knowledge Proof (ZKP) is starting to attract serious attention. Market watchers describe it as a privacy-focused network built on zero-knowledge verification, with a use case that is easy to understand. Instead of sharing more data, the system is designed to provide only what is required, and nothing beyond that.

ZKP Confirms Without Exposing: Privacy Blockchain in Action

ZKP is being discussed by analysts as an infrastructure-level blockchain effort centered on zero-knowledge verification, with a simple but powerful aim: confirm claims without exposing private information. Rather than leaning on hype alone, the network is structured to support real verification needs such as identity checks, eligibility confirmation, and trust validation while keeping sensitive data protected.

Its rollout is backed by notable figures. Reports highlight around $100M already allocated to infrastructure, paired with a presale auction model that operates daily using a fixed release of 190M coins per day. Participation starts with a $20 minimum, while a $50,000 wallet limit is in place to reduce early concentration and support wider access during the live presale auction.

This design matters because ZKP’s main idea is easy for everyday users to grasp. When people show an ID to confirm age, far more information is often revealed than needed. ZKP focuses on confirming details such as “over 21” without sharing addresses, ID numbers, or full identity records. Analysts argue that this approach directly reduces common identity misuse risks.

For this reason, ZKP is increasingly described as the best crypto to buy for those seeking scalable utility. If privacy-first verification becomes standard across apps, payments, and onboarding systems, demand could grow quickly rather than remain niche.

With expert projections reaching as high as 7000x upside, ZKP is being framed as a rare combination of real demand, controlled supply through its live presale auction, and strong narrative momentum. This mix explains why many continue to highlight it as the best crypto to buy heading into 2026.

Stellar (XLM) Holds Steady Amid Range-Bound Trading

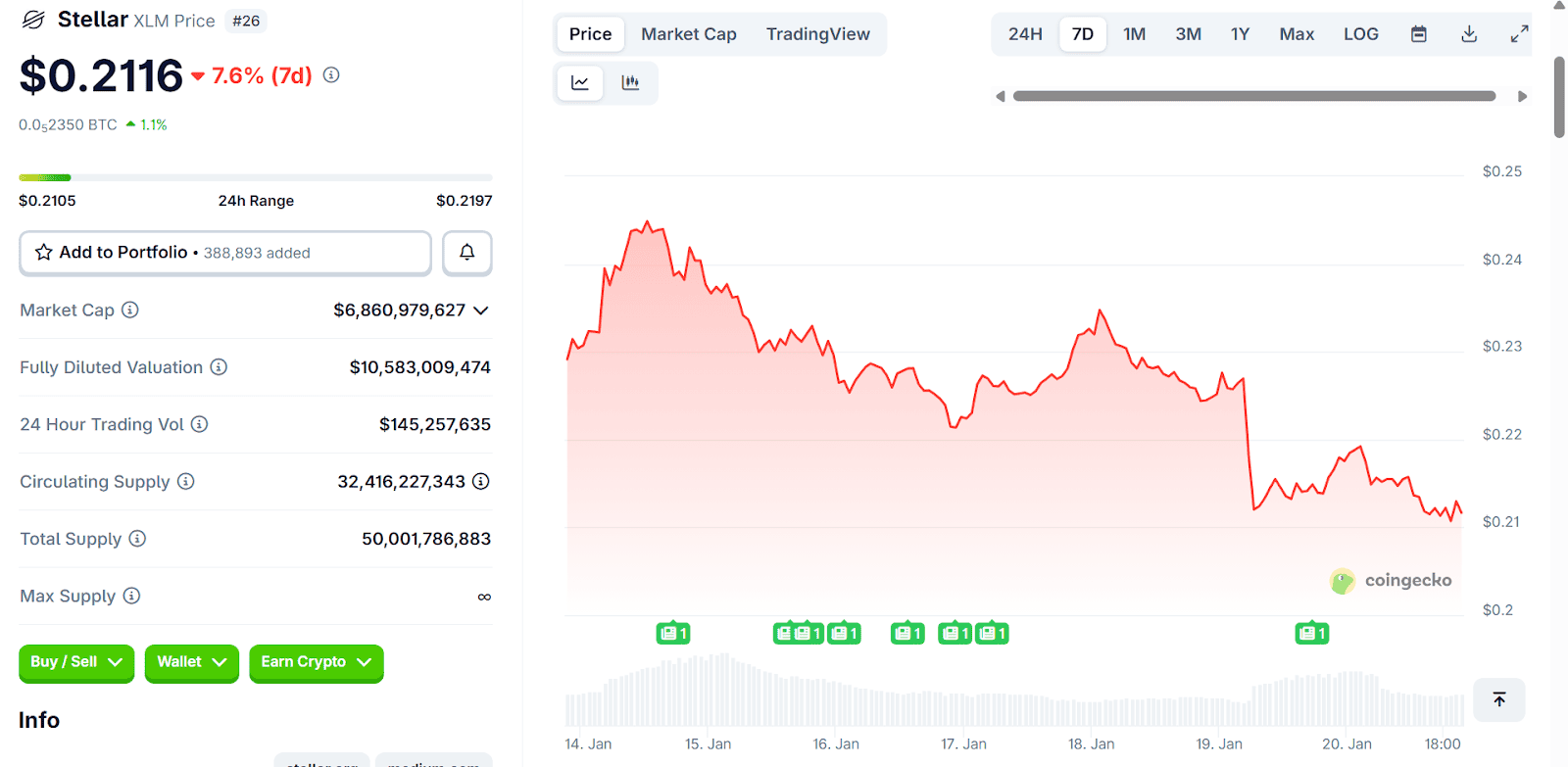

Stellar (XLM) continues to trade in the $0.21 to $0.23 area, supported by roughly $143M in daily volume and a market cap near $6.8B, keeping it among established altcoins. From an XLM Stellar price prediction view, the current range looks stable, yet traders remain focused on whether momentum can return.

Source: CoinGecko

Source: CoinGecko

Most short-term outlooks place XLM within a January band of $0.204 to $0.270, with an average near $0.214, closely matching recent price action. The key hurdle remains the $0.25 to $0.27 zone. A firm move above this area could shift XLM Stellar price prediction discussions toward renewed trend building rather than sideways movement.

SUI Price Prediction: Can Stability Hold Above $1.50?

SUI traded near $1.56 during 19 to 20 January 2026 after a sharp daily decline of roughly 7% to 8%, with prices ranging from about $1.53 to $1.69. Trading volume stayed active around 73M, indicating solid participation. For SUI price prediction, attention is now centered on whether the asset can remain stable in the mid-$1.50 range instead of sliding lower.

Current support sits between $1.52 and $1.55, with $1.50 acting as a key line. Some technical views also point to $1.40 as a deeper support if weakness returns. On the upside, reclaiming $1.69 to $1.70 would improve the short-term structure, while $2.00 remains the level many traders want to see challenged again. With a market cap near $5.7B and around 3.8B coins in circulation, SUI price prediction will depend on how quickly confidence is rebuilt.

Final Say

XLM Stellar price prediction continues to focus on range behavior, with XLM holding near $0.21 to $0.23 as traders watch the $0.25 to $0.27 area for signs of a breakout. The setup appears steady, yet upside still depends on overcoming strong resistance and maintaining demand.

SUI price prediction remains more reactive. SUI is holding close to $1.55 after a steep drop, with $1.50 acting as an important support. A recovery above $1.69 to $1.70 would help the short-term outlook, while $2.00 is still the level tied to a broader turnaround.

This contrast highlights why ZKP stands out. Analysts point to its privacy-first design that proves eligibility without revealing sensitive data, directly addressing common identity risks. With its infrastructure live, network active, presale auction ongoing, and proof pods already delivering and shipping, ZKP is increasingly positioned as the best crypto to buy for those looking beyond limited upside narratives.

Explore Zero Knowledge Proof:

Website: https://zkp.com/

Buy: https://buy.zkp.com

Telegram: https://t.me/ZKPofficial

X: https://x.com/ZKPofficial

| Disclaimer: The text above is an advertorial article that is not part of CoinLineup editorial content. |

You May Also Like

The Channel Factories We’ve Been Waiting For

XRP Escrow Amendment Gains Momentum, Set for February 2026 Activation