Aave to Enter 2026 With a Master Plan, SEC Ends 4-Year Investigation

US regulators officially closed a long-running investigation into DeFi protocol Aave AAVE $179.2 24h volatility: 4.8% Market cap: $2.73 B Vol. 24h: $302.45 M after dropping cases against Ondo Finance (ONDO) earlier this month.

Also, Aave’s founder has shared a long-term roadmap that discusses how the platform plans to scale into one of the core credit systems of the onchain economy.

SEC Closes Four-Year Investigation Into Aave

Aave founder Stani Kulechov confirmed that the US Securities and Exchange Commission has ended its investigation into the DeFi protocol without taking enforcement action.

The probe lasted nearly four years and included a Wells Notice, which is usually a sign that regulators are considering legal action.

According to information shared by Kulechov, the SEC informed Aave in a letter dated August 15 that it does not plan to recommend enforcement.

The investigation began under former US President Joe Biden, when regulators took a tougher stance on digital assets.

https://x.com/StaniKulechov/status/2000963157150388267

Aave Labs confirmed that it had remained in regular contact with regulators throughout the process and can now operate without legal uncertainty.

Aave’s Long-Term Roadmap and Scale

Kulechov released a detailed roadmap outlining how Aave plans to grow in the coming years. The strategy focuses on three core areas: Aave V4, Horizon, and the Aave App.

https://x.com/StaniKulechov/status/2001036446098919461

The goal is to move the next trillion dollars in assets and onboard millions of new users onchain.

Interestingly, data shared by Kulechov shows the platform has processed more than $3.33 trillion in total deposits since launch and has issued close to $1 trillion in loans.

This year alone, Aave generated around $885 million in fees and currently controls about 59% of the DeFi lending market. Kulechov described Aave as still being in its early stage despite its size.

As explained by Kulechov, Aave V4 is a full redesign of the protocol’s structure. The new version is designed to combine liquidity across different networks into unified hubs. Horizon, which launched earlier this year, focuses on regulated and compliance-aligned lending.

On the other hand, the Aave App is designed for everyday users and aims to simplify access to DeFi.

AAVE Price Analysis: Market Still Cautious

AAVE price has not reacted positively in the short term. The token was down around 2% on Wednesday, while trading volume dropped by roughly 28%.

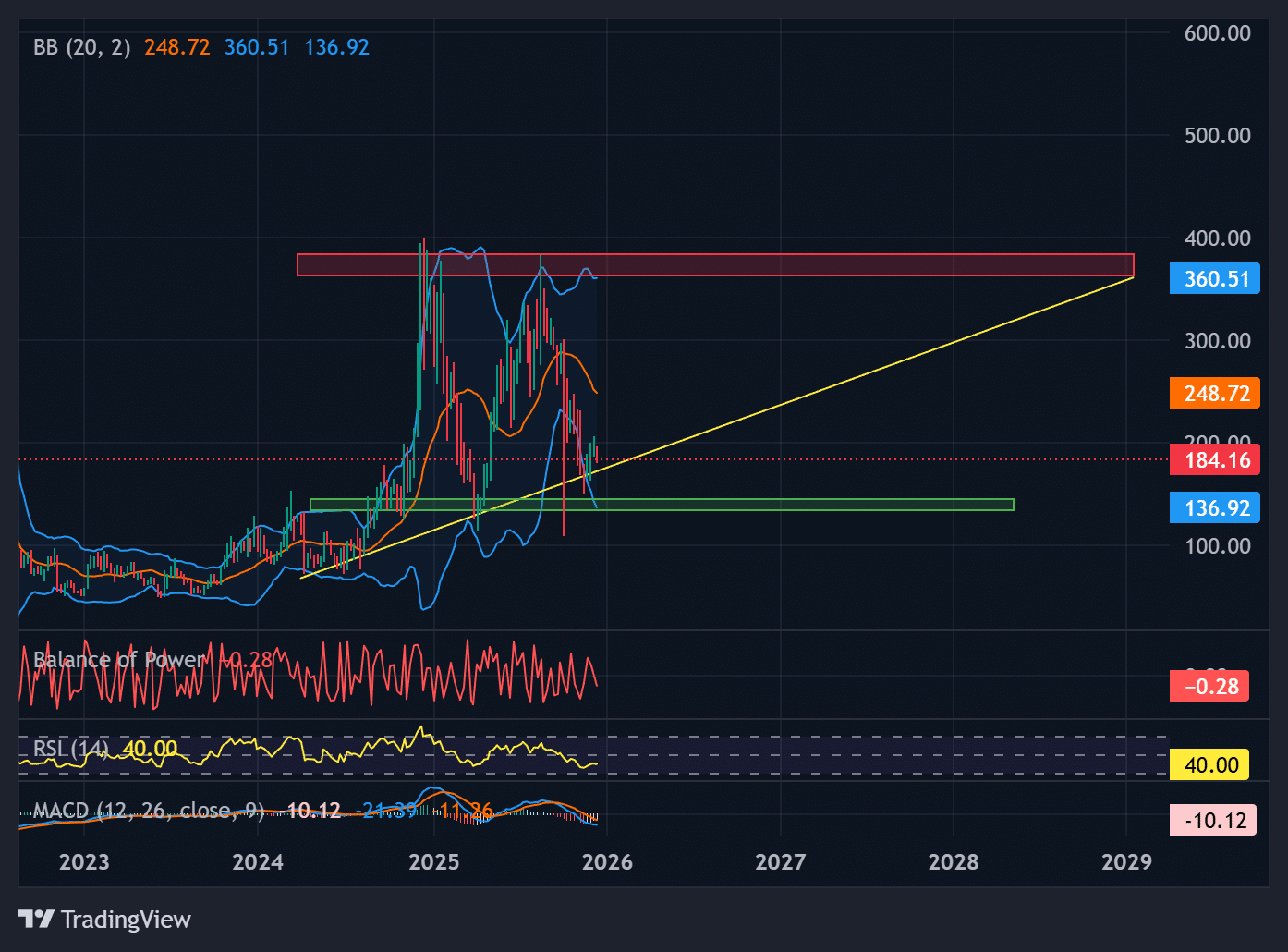

As per the chart below, the altcoin is trading below a major resistance zone near the upper Bollinger Band, around the $360 area.

-

- AAVE price analysis on weekly chart. | Source: TradingView

If selling continues, the chart shows a key support zone near the $135 to $150 range. Holding this area could stabilize prices.

However, AAVE would need to reclaim the $250 to $280 region first, followed by a clean move above $360, to signal a stronger recovery.

nextThe post Aave to Enter 2026 With a Master Plan, SEC Ends 4-Year Investigation appeared first on Coinspeaker.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

ServicePower Closes Transformative Year with AI-Driven Growth and Market Expansion