XRP Price: First U.S. ETF Goes Live Thursday as Bulls Eye Breakout Above $3

TLDR

- REX-Osprey launches the first U.S. XRP ETF on September 18 under ticker XRPR

- CME Group plans to list options on XRP futures starting October 13

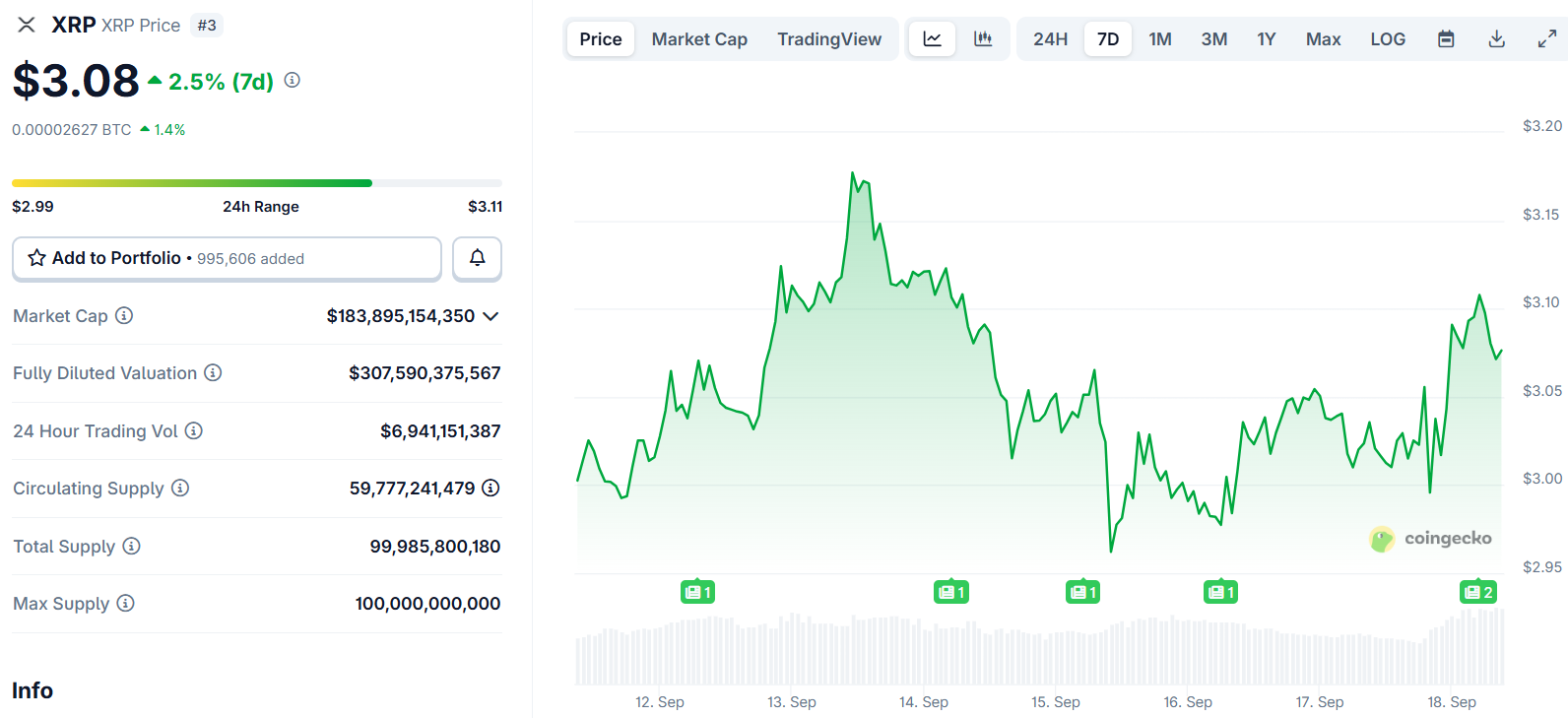

- XRP trading around $3.03, down nearly 1% in the past 24 hours

- Historical data shows XRP often outperforms equities by 10x during Fed rate cut cycles

- Short positions clustered around $3.10-$3.15 could trigger squeeze if price breaks higher

XRP enters a new phase today with the launch of the first U.S. exchange-traded fund offering exposure to the cryptocurrency. The REX-Osprey XRP ETF begins trading on the Cboe BZX Exchange under ticker XRPR.

The fund represents a milestone for XRP investors in the United States. Previously, American brokerage accounts could only access bitcoin and ethereum ETFs in the crypto space.

The new ETF uses a hybrid structure to achieve XRP exposure. It holds XRP directly while also investing in spot ETFs from outside the U.S. The fund’s filings include language allowing derivatives use if needed, though this is not the primary approach.

Bloomberg Intelligence analyst James Seyffart noted the funds are not “pure” spot products. The structure reflects the regulatory realities of building crypto ETFs in the U.S. market.

CME Expands Derivatives Offerings

CME Group announced plans to list options on XRP futures starting October 13. The move comes pending regulatory review and follows strong growth in the exchange’s altcoin futures products.

Since March, Solana futures have logged over 540,000 contracts traded worth about $22.3 billion. XRP futures, introduced in May, have seen more than 370,000 contracts change hands representing roughly $16.2 billion in notional value.

The options will be available on both standard and micro contracts. Expiry choices will include daily, monthly, and quarterly terms to serve different trading strategies.

Market participants including Cumberland and FalconX have welcomed the additions. They cite the need for hedging tools beyond bitcoin and ethereum in the growing altcoin market.

Market Position and Technical Levels

XRP was trading around $3.03 at the time of writing, down nearly 1% over the past 24 hours. The price holds above the key $3 psychological level as traders watch for reactions to the new products.

XRP Price

XRP Price

Technical analysis shows short positions clustered around $3.10 to $3.15. A break above this range could trigger forced covering from short sellers.

Historical patterns from JPMorgan data suggest XRP tends to outperform during Federal Reserve rate cutting cycles. When the Fed cuts rates while equities trade near highs, stocks typically gain 15% over the following 12 months.

XRP has historically amplified these equity gains by a factor of ten during similar periods. Lower interest rates reduce the opportunity cost of holding non-yielding assets like cryptocurrencies.

The Federal Reserve meets this week with traders watching for either a 25 or 50 basis point rate cut. The size and accompanying guidance could influence crypto market sentiment.

If the ETF attracts strong inflows similar to recent Solana funds, analysts see potential for XRP to test resistance around $3.20 and $3.35. The all-time high of $3.66 remains the ultimate technical target.

On the downside, weak demand could see prices retreat toward $2.80 or $2.50 support levels. The ETF’s performance in its first days of trading will be closely monitored.

XRP futures open interest and trading volume have both increased ahead of the ETF launch. This suggests heightened interest from both institutional and retail participants.

The cryptocurrency has formed what some analysts call an eight-year accumulation base. A confirmed breakout above $3.35 could target much higher levels in the coming months.

The combination of new institutional products and favorable monetary policy creates a potentially supportive environment. However, regulatory uncertainty and market volatility remain factors to watch.

CME Group operates the world’s largest regulated derivatives marketplace. Adding XRP options continues the exchange’s expansion beyond bitcoin and ethereum into liquid altcoins.

The post XRP Price: First U.S. ETF Goes Live Thursday as Bulls Eye Breakout Above $3 appeared first on CoinCentral.

You May Also Like

Ethereum Hong Kong Hub was launched at the 2025 Hong Kong Digital Asset Forum.

Soluna en Canaan starten 20 MW wind-powered Texaanse bitcoinmijn

Fintechs and neobanks drive the next era of stablecoin adoption

Fintechs bypass traditional banking to offer stablecoin access, yield and spending in emerging markets. Programmable money leapfrogs legacy infrastructure. Opinion by: Morgan Krupetsky, vice president of Onchain Finance at Ava LabsOn the heels of the GENIUS Act’s passing, the next era of stablecoin usage is being driven by a growing cohort of fintechs and neobanks — integrating stablecoins into their product and service offerings, going where traditional systems have found it economically or operationally infeasible to do so, and, as such, growing their competitive edge. These challenger systems are providing a direct way for people and businesses to more readily access and store stable value in mobile wallets; to navigate financial stability concerns around hyperinflation and currency volatility; to effectuate remittances and other cross-border transactions; to access credit and savings; and ultimately to spend down or against their holdings in real time. Read more