Michael Saylor “We Are in a Crypto Winter” as Markets Continue Weakness

- Michael Saylor confirmed that the cryptocurrency market is currently in a crypto winter, describing it as milder and shorter than previous cycles.

- Since February 1, Bitcoin and major altcoins have declined, with BTC trading around $68,000 and ETH near $1,980 as of today.

Strategy Executive Chairman Michael Saylor has said the cryptocurrency market is in a “crypto winter,” acknowledging the sustained downturn after earlier statements that such a phase would not return. In a Tuesday interview on Fox Business, Saylor described the current market drawdown as a significant correction, marking what he called the fifth major drawdown for Bitcoin since he entered the space. He characterised this cycle as “milder” and potentially shorter than the downturns seen in past cycles, citing institutional interest and policy support.

Michael Saylor later reiterated similar sentiment in a post on X, saying: “We may be in the middle of a crypto winter, but spring is coming — and Bitcoin is winning.”

Saylor’s comments come as Strategy continues to accumulate Bitcoin. Between Feb. 9 and Feb. 16, the firm acquired 2,486 BTC for approximately $168.4 million at an average price of about $67,710 per coin. The purchase brings its total holdings to 717,131 BTC, as per the 8-K filing with the Securities and Exchange Commission on Tuesday. This makes Strategy one of the largest corporate holders of Bitcoin, even as its aggregate cost basis remains above current prices, reflecting unrealized paper losses.

Saylor also said Strategy could withstand a further sharp decline in Bitcoin’s price, stating in public remarks that the company could survive even if BTC were to fall as low as $8,000 given its cash reserves and capital structure.

Also, Saylor pointed to what he described as stronger institutional and political support for Bitcoin compared with prior bear markets, citing the development of digital credit networks and a U.S. administration he views as supportive of digital assets.

Feb. 5–6 Liquidations Drive Significant Market Decline Across Major Cryptocurrencies

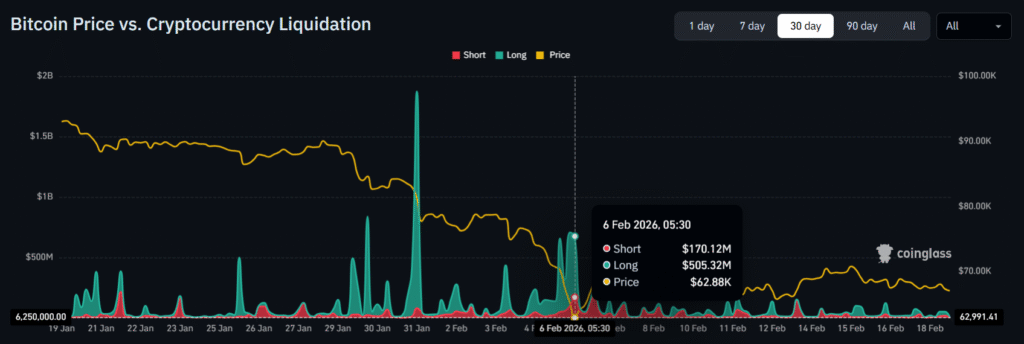

Over $1.45 billion in leveraged positions were liquidated across major cryptocurrencies within a 24‑hour period on Feb. 5, 2026, marking one of the largest single‑day liquidation events in recent weeks. Bitcoin accounted for roughly $738.83 million of those liquidations, with Ethereum’s long positions near $337.45 million and Solana around $77.28 million. Long positions made up the bulk of these forced closures as prices breached key support levels.

Additionally, Feb. 6 saw an even broader cascade of forced closures, with derivatives platforms showing roughly $2.6 billion future positions in total liquidations as Bitcoin briefly plunged toward $60,000 before rebounding later in the day and the Fear & Greed Index fell into extreme fear territory. Over 580,000 trader positions were reportedly wiped out during that period amid the steep price swings.

(Source: Coinglass)

(Source: Coinglass)

Crypto market performance has started to move downward with mixed results since the beginning of February. The largest single short-term drop occurred on Feb. 6, when Bitcoin fell from around $71,681 to $60,074 intraday, a drop of around 16%. As of today, Bitcoin is trading around $68,000, down approximately 15% from its price near $79,322 on Feb. 1. Data from CMC show BTC’s market cap remains above $1.34 trillion.

Ethereum (ETH), the second-largest token by market cap, traded near $2,400 at the start of February, then fell below $1,748 during the early-month downturn before stabilising. As of today, ETH is trading around $1,970–$1,990, down roughly 27% since Feb. 1. The ETH market cap remains above $237 billion.

Other major tokens such as XRP and Solana (SOL) experienced similar patterns. XRP began February near $1.62, briefly retreating toward $1.15 before recovering slightly to trade near $1.45–$1.50 today, a decrease of more than 10% since the start of the month. SOL started February above $100–$115, dropped below $75 on Feb. 6, and currently trades near $82–$86, down roughly 12–15%.

However, analysts note that upcoming developments, such as potential ETF activity and continued institutional buying, could influence market momentum in the coming weeks.

Highlighted Crypto News:

BlackRock Begins Acquiring Ethereum Ahead of Staking ETF Launch

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Russia’s Central Bank Prepares Crackdown on Crypto in New 2026–2028 Strategy