What is River? The Technical Architecture and Tokenomics Behind a Multi-Billion Dollar On-Chain Bank

TL;DR

1) River uses Omni-CDP technology to enable cross-chain collateralization and minting, allowing users to deposit assets on one chain and natively mint satUSD on another.

1. What Is River?

2. River Tokenomics

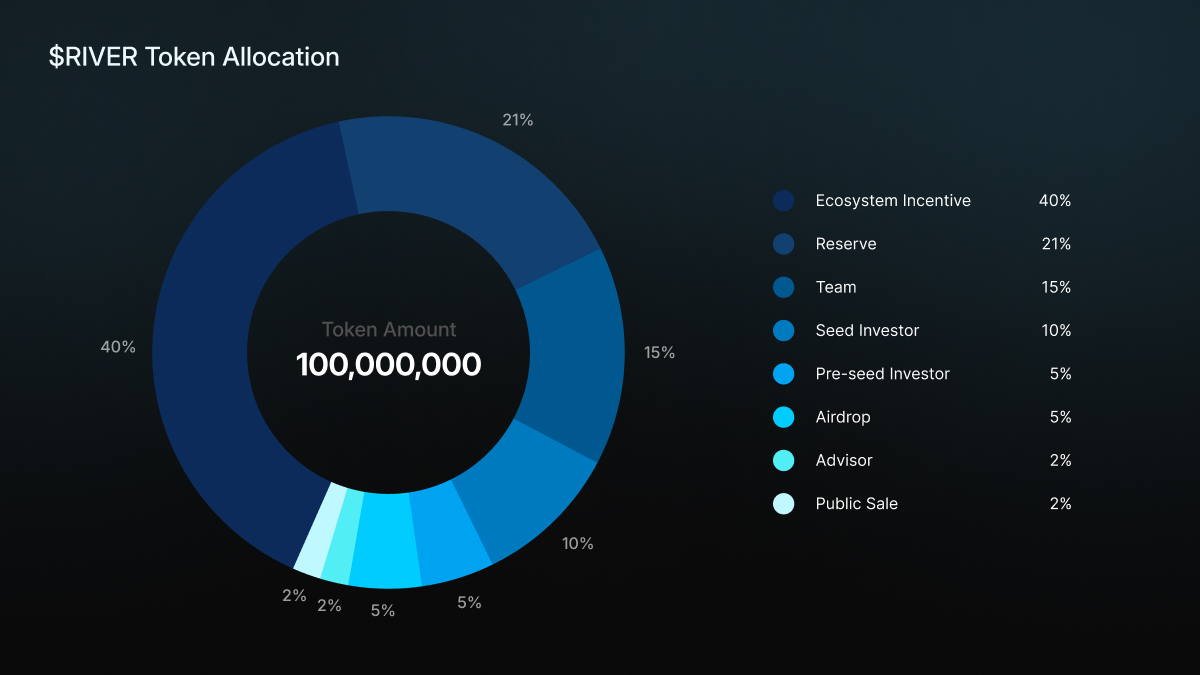

2.1 RIVER Token Allocation

Allocation Category | Percentage | Purpose Description |

Ecosystem Incentives | 40% | User rewards, liquidity incentives, ecosystem growth |

Reserve Fund | 21% | Market making, marketing, and protocol expansion |

Team | 15% | Core team incentives |

Seed Investors | 10% | Seed round financing |

Airdrop | 5% | Community airdrop rewards |

Pre-Seed Investors | 5% | Early-stage investors |

Public Sale | 2% | Public token sale |

Advisors | 2% | Project advisors |

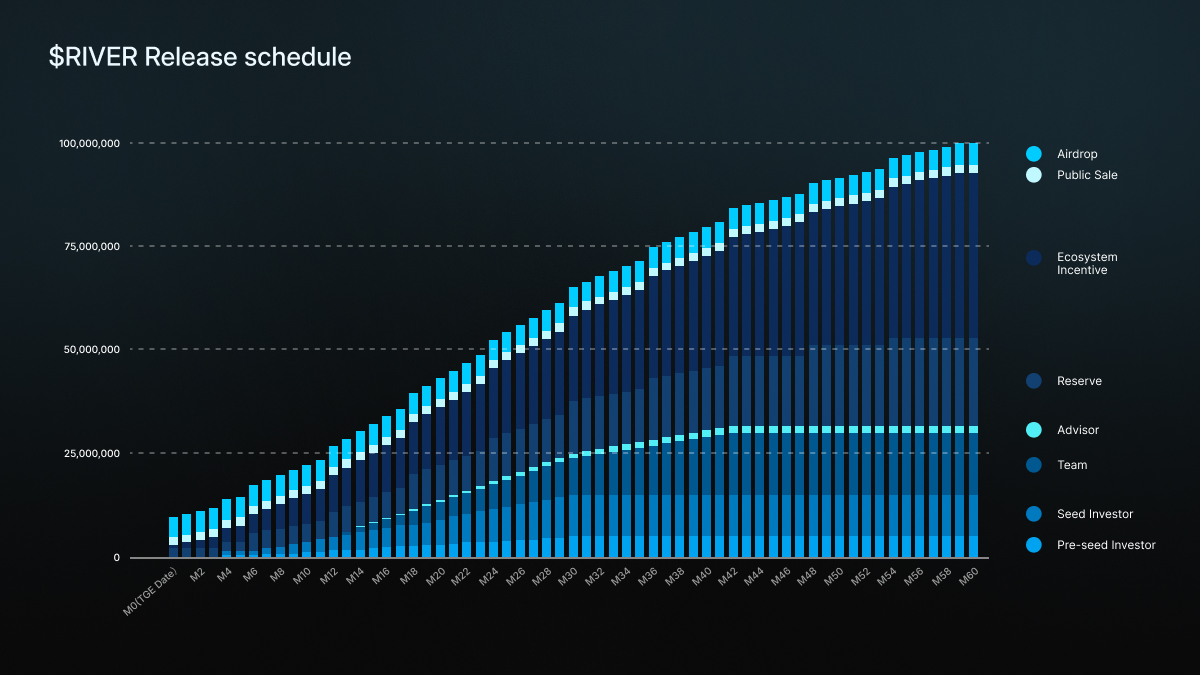

2.2 RIVER Token Vesting

Allocation Category | Lock-up Period | Vesting Schedule |

Airdrop | None | Fully unlocked immediately |

Public Sale | None | Fully unlocked immediately |

Ecosystem Incentives | None | Linear vesting over 60 months |

Reserve Fund | None | Linear vesting over 60 months, released every 6 months |

Pre-Seed Investors | 3 months | 10% unlocked in the 4th month, locked for another 6 months, then linear vesting over 24 months |

Seed Investors | 3 months | 10% unlocked in the 4th month, locked for another 6 months, then linear vesting over 24 months |

Team | 12 months | Linear vesting over 30 months |

Advisors | 12 months | Linear vesting over 30 months |

2.3 Utility of the RIVER Token

- Types of collateral and risk parameters within the CDP system

- Decisions on blockchain expansion and deployment

- satUSD incentive emission schedules

- Treasury usage and ecosystem grant proposals

- veRIVER Mechanism: Locking RIVER as veRIVER provides higher satUSD+ yields

- Liquidity Provider Rewards: Long-term stakers receive enhanced incentives

- River4FUN Multipliers: Participants in River4FUN can gain 1.2 times-2 times multipliers on activities and contributions

- Fee Reductions: Lower minting, redemption, and swap fees

- Priority Access: Early participation in limited events and eligibility for premium rewards

- Additional Benefits: Potential participation in governance-related airdrops or distributions

3. Core Technological Innovation of River: The Omni-CDP System

3.1 What Is Omni-CDP?

- Collateralize ETH on Ethereum

- Mint satUSD on BNB Chain

- Use satUSD on Arbitrum

3.2 Supported Collateral Types

- Liquid Staking Tokens (LSTs): River supports multiple LSTs as collateral, allowing users to access liquidity while continuing to earn staking rewards.

- Stablecoin conversion: In addition to minting through collateralization, users can also convert USDT, USDC, USD1, and other stablecoins directly into satUSD at a 1:1 ratio.

3.3 Zero-Interest Advantage

4. satUSD: More Than a Stablecoin

4.1 The Unique Design of satUSD

- Overcollateralization mechanism: satUSD employs an overcollateralized model to ensure that every token is fully backed by sufficient assets. This provides a solid foundation for maintaining its value.

- Omnichain circulation: Built on the LayerZero OFT standard, satUSD can circulate natively across multiple blockchains, including Ethereum, BNB Chain, Base, Arbitrum, Sonic, BOB, BSquared, Hemi, BEVM, and Bitlayer.

4.2 Price Stability Mechanism

- Real-time liquidation system: When the collateralization ratio falls to a dangerous level, the system automatically triggers liquidations to ensure the solvency of the protocol.

- On-chain arbitrage mechanism: When the price of satUSD falls below one dollar, arbitrageurs buy satUSD and redeem it for collateral; when the price rises above one dollar, arbitrageurs mint new satUSD and sell it.

- Five-layer risk control: River implements a comprehensive five-layer risk control framework, including Recovery Mode and other mechanisms, to safeguard the protocol's overall stability.

4.3 satUSD+: Yield-Bearing Stablecoin

- Protocol revenue sharing: Holders receive a share of the revenue generated by the River protocol.

- Maintained liquidity: satUSD+ remains usable within DeFi even while staked.

- Flexible redemption: satUSD+ can be redeemed back into satUSD at any time.

5. The Four Pillars of the River Ecosystem

5.1 Omni-CDP Module

- Collateralize assets across multiple chains

- Mint satUSD natively on any supported chain

- Eliminate reliance on cross-chain bridges

- Benefit from zero-interest issuance

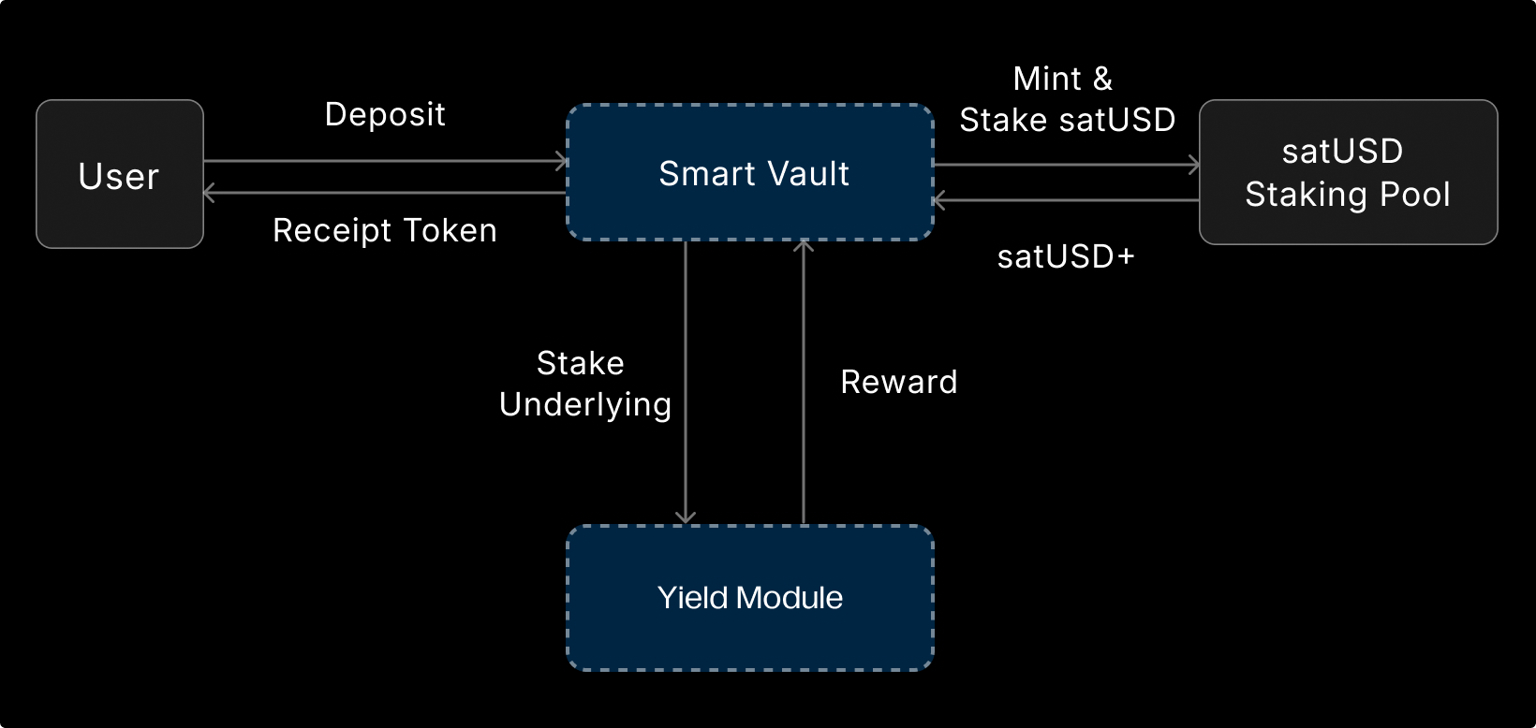

5.2 Smart Vault

- Sustainable returns: Generates stable yield through a combination of DeFi and CeDeFi strategies.

- No liquidation risk: Unlike CDPs, assets deposited into Smart Vaults are not subject to liquidation, allowing users to hold with confidence.

- Flexible strategies: Users can select from different strategy combinations based on individual risk preferences.

- Institutional-grade option: River also offers Prime Vault, designed for institutional investors. Custodied by Ceffu and Cobo, it provides enterprise-level security and stable yield solutions.

5.3 River4FUN: Social Contribution Layer

- X (Twitter) integration: Users can link their X accounts and earn River Points through posting, reposting, and engaging with social content.

- Staking-based mining: Users can stake any token to accumulate River Points and receive daily rewards.

- Governance participation: Community members can vote on proposals and earn rewards for their participation.

- AI-driven distribution: River4FUN leverages AI agents to allocate rewards based on engagement levels and community momentum, ensuring fairness and efficiency.

5.4 Swap Function

- Low slippage trading for optimal execution

- Multi-chain support across integrated networks

- Instant settlement for seamless transactions

- DEX integration with leading decentralized exchanges

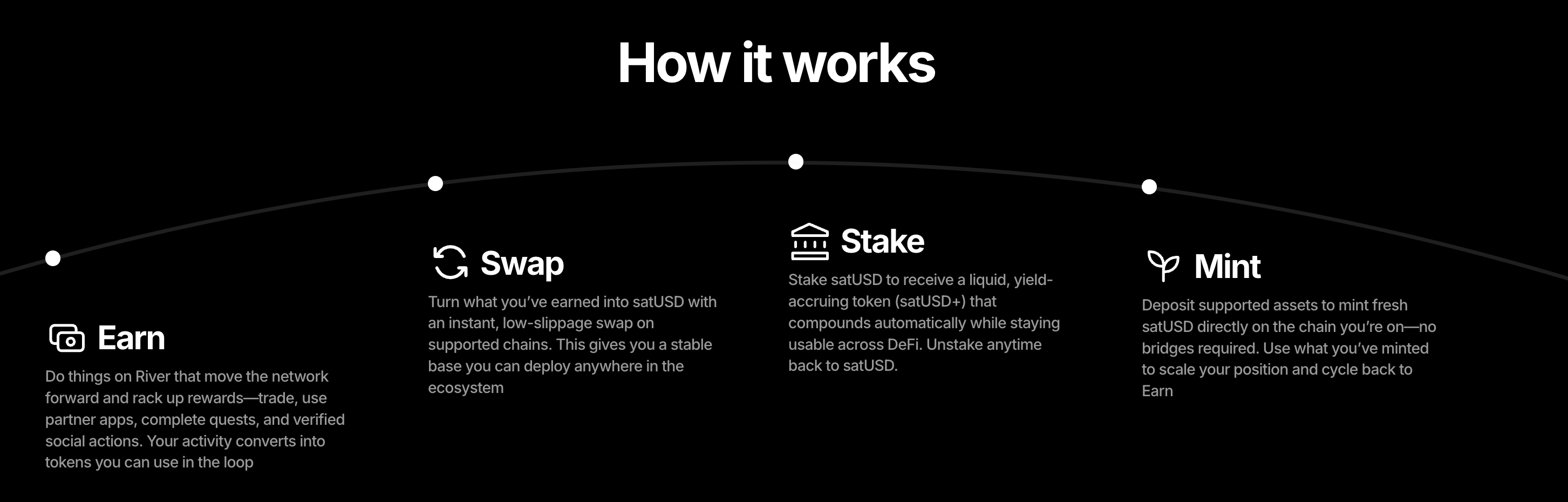

6. River's Operational Cycle

6.1 Earn

6.2 Swap

6.3 Stake

- Automatically compounding yield

- Continued usability within DeFi

- Flexible redemption at any time

- Participation in protocol revenue sharing

6.4 Mint

- No cross-chain bridging required

- Expand positions efficiently

- Cycle back into the Earn stage

7. River Use Cases and Earning Opportunities

7.1 Leverage Strategies

- Repeated lending and borrowing to amplify returns

- Access liquidity without selling underlying assets

- Cross-chain arbitrage opportunities

7.2 Liquidity Mining

- Pendle: 5-25 times River points multiplier

- PancakeSwap: Liquidity provider incentives

- Segment: Lending yields

- LayerBank: Deposit rewards

7.3 Stable Yield

Popular Articles

How High Will Ethereum Go? Price Predictions for 2026-2030

Ethereum has evolved from an experimental blockchain into the backbone of decentralized finance, NFTs, and smart contracts. With ETH trading around $2,900 in December 2025, investors are asking: how h

MEXC Pre-Market Trading Guide: How to Trade Tokens Before Listing & FAQ

1. What Is Pre-Market Trading?Pre-Market Trading is an over-the-counter (OTC) service offered by MEXC. It gives traders the opportunity to buy and sell new tokens before they are officially listed on

How to Buy Ethereum (ETH) - Step-by-Step Guide for Beginners

Ethereum stands as the second-largest cryptocurrency by market capitalization, powering everything from decentralized finance platforms to NFT marketplaces.This guide breaks down how to buy Ethereum s

How to Apply for the MEXC × ether.fi Credit Card

MEXC is pleased to partner with ether.fi to launch the enhanced MEXC × ether.fi Credit Card, offering upgraded cashback rewards that go beyond the standard ether.fi Card.Spend globally with Apple Pay

Hot Crypto Updates

Snowball (SNOWBALL) Price Targets

Introduction to SNOWBALL Price TargetsCryptocurrency traders often rely on price targets for Snowball (SNOWBALL) to plan their trading strategies and gauge market sentiment. SNOWBALL price targets pro

Snowball (SNOWBALL) Price Chart: Live Data & Technical Analysis

The live Snowball (SNOWBALL) price chart provides a dynamic view of market action, showing how traders and investors are positioning in real time. By studying cryptocurrency price charts, you can iden

Snowball (SNOWBALL) vs Ethereum (ETH) Price

The Snowball (SNOWBALL) price compared with the Ethereum (ETH) price offers a valuable perspective for crypto traders and investors seeking to understand digital asset dynamics. Since ETH is the secon

Snowball (SNOWBALL) Long-Term Price Prediction

Introduction to Snowball Long-Term Price PredictionWhen it comes to crypto investments, long-term outlooks often provide deeper insight than short-term speculation. Long-term price predictions for Sno

Trending News

The “Bitcoin Senator” Sets Her Departure: A Final Chapter for Cynthia Lummis

In a move that has surprised both Washington and the digital asset community, Senator Cynthia Lummis (R-Wyo.) officially announced on December 19, 2025, that she

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future

Ethereum founder, Vitalik Buterin, has unveiled new goals for the Ethereum blockchain today at the Japan Developer Conference. The plan lays out short-term, mid-term, and long-term goals touching on L

Water hyacinths and ripple effects: How your favorite shopping app helped this women-driven initiative

Meet Remdavies, one of the MSMEs that reached a wider audience through Shopee

Strategy (MSTR) Stock: Saylor’s Green Dots Signal More Bitcoin Buying Despite Stock Weakness

TLDR Michael Saylor posted cryptic “Green Dots” message on December 21, signaling potential new Bitcoin purchase by Strategy Strategy holds 671,268 BTC (3.2% of

Related Articles

How High Will Ethereum Go? Price Predictions for 2026-2030

Ethereum has evolved from an experimental blockchain into the backbone of decentralized finance, NFTs, and smart contracts. With ETH trading around $2,900 in December 2025, investors are asking: how h

MEXC Pre-Market Trading Guide: How to Trade Tokens Before Listing & FAQ

1. What Is Pre-Market Trading?Pre-Market Trading is an over-the-counter (OTC) service offered by MEXC. It gives traders the opportunity to buy and sell new tokens before they are officially listed on

How to Buy Ethereum (ETH) - Step-by-Step Guide for Beginners

Ethereum stands as the second-largest cryptocurrency by market capitalization, powering everything from decentralized finance platforms to NFT marketplaces.This guide breaks down how to buy Ethereum s

How to Apply for the MEXC × ether.fi Credit Card

MEXC is pleased to partner with ether.fi to launch the enhanced MEXC × ether.fi Credit Card, offering upgraded cashback rewards that go beyond the standard ether.fi Card.Spend globally with Apple Pay