Global Macroeconomic Calendar: Unmissable Events Shaping Crypto Markets This Week

BitcoinWorld

Global Macroeconomic Calendar: Unmissable Events Shaping Crypto Markets This Week

For anyone navigating the dynamic world of cryptocurrencies, understanding the broader financial landscape is absolutely crucial. This week’s Global Macroeconomic Calendar is packed with events that could significantly sway market sentiment, impacting everything from Bitcoin’s price action to altcoin volatility. Staying informed about these key financial events isn’t just about traditional markets; it’s about anticipating potential shifts that reverberate across the entire digital asset ecosystem. Let’s dive into what’s on the horizon.

Why Does the Global Macroeconomic Calendar Influence Crypto?

You might wonder why central bank speeches or employment data in the U.S. have a bearing on decentralized digital assets. The truth is, global economic health, interest rate policies, and inflation concerns directly affect investor risk appetite. When traditional markets face uncertainty or interest rates rise, investors often pull back from riskier assets, including cryptocurrencies.

Conversely, a stable or expansionary economic outlook can encourage capital flow into digital assets. Therefore, closely monitoring the Global Macroeconomic Calendar provides a significant edge. This week presents several pivotal moments that could offer insights into the future direction of monetary policy and economic health. Understanding these events can help you make more informed decisions.

Monday, November 4: Kicking Off with Fed Insights

- 11:35 a.m. UTC: FOMC member Michelle Bowman speaks.

The week begins with insights from a Federal Open Market Committee (FOMC) member. Michelle Bowman’s remarks will be closely watched for hints on the Federal Reserve’s stance on interest rates, inflation, or the overall economy. Her perspective offers valuable context for market participants. It could influence dollar strength and, by extension, crypto market sentiment. Pay close attention to her tone.

Tuesday, November 5: Unpacking US Employment Data

- 1:15 p.m. UTC: U.S. October ADP Non-Farm Employment Change.

Employment data is a critical indicator of economic health. The ADP Non-Farm Employment Change report offers an early look at private sector job creation in the U.S. A stronger-than-expected report might signal a robust economy, potentially leading the Fed to maintain a hawkish stance on interest rates.

Conversely, a weaker report could suggest economic slowdown, possibly leading to a more dovish outlook. Both scenarios can trigger significant market reactions, making this a key highlight on the Global Macroeconomic Calendar.

Wednesday, November 6: Central Banks and Fed Voices in Focus

Wednesday is particularly busy, featuring decisions and discussions from major central banks and top Fed officials. These events are often catalysts for market volatility.

- 12:00 p.m. UTC: Bank of England interest rate decision.

The Bank of England’s (BoE) interest rate decision will impact the British Pound. It could have broader implications for global liquidity and risk appetite. While not directly U.S.-centric, major central bank actions contribute to the global financial environment that crypto markets operate within. A surprise move could ripple across continents.

- 4:00 p.m. UTC: U.S. Federal Reserve Vice Chair Michael Barr and FOMC member John Williams speak.

- 8:30 p.m. UTC: Federal Reserve Governor Christopher Waller speaks.

Multiple Fed officials speaking on the same day can create a confluence of opinions. Vice Chair Barr, along with FOMC members Williams and Governor Waller, will likely touch upon economic conditions, inflation, and monetary policy. Their collective comments will offer a comprehensive view of the Fed’s current thinking.

Any divergence in their views or strong signals about future policy moves could cause significant market shifts. This makes it a pivotal day on the Global Macroeconomic Calendar for crypto traders.

Thursday, November 7: Wrapping Up with More Fed Commentary

- 8:00 a.m. UTC: FOMC member John Williams speaks.

The week concludes with another address from FOMC member John Williams. Following his previous remarks and those of other Fed officials, his second speech of the week might reiterate key messages or provide further clarification. Traders will be looking for consistency or any subtle shifts in the Fed’s communication. This final piece of the puzzle can help solidify market expectations for the near future.

How Can You Navigate This Week’s Economic Landscape?

Navigating a week filled with such important economic data requires a proactive approach. Here are some actionable insights:

- Stay Informed: Continuously monitor news feeds and reputable financial calendars for real-time updates on these events.

- Understand Impact: Research how specific economic indicators (like employment data or interest rates) have historically affected crypto markets.

- Risk Management: Be prepared for increased volatility around these announcement times. Consider adjusting your positions or setting stop-loss orders.

- Long-Term View: While short-term reactions are common, remember that the fundamental value proposition of many cryptocurrencies is not solely dependent on weekly macroeconomic shifts.

The challenges lie in the unpredictability of market reactions. Even anticipated news can sometimes lead to unexpected price movements. However, by understanding the potential implications of each event on the Global Macroeconomic Calendar, you empower yourself to react more strategically.

A Week of Crucial Insights for Crypto Enthusiasts

This week’s Global Macroeconomic Calendar is undeniably a busy one, offering a wealth of information that could shape both traditional and crypto markets. From Federal Reserve officials providing clarity on monetary policy to key employment data and central bank decisions, each event holds the potential to influence investor sentiment and market direction. By staying informed and understanding the underlying implications, crypto traders and investors can better position themselves to navigate the exciting, yet often volatile, digital asset landscape. Keep these dates and times marked, and prepare to adapt to the unfolding economic narrative.

Frequently Asked Questions (FAQs)

Q1: What is the Global Macroeconomic Calendar?

A: The Global Macroeconomic Calendar is a schedule of significant economic events, data releases, and speeches from central bank officials that can influence financial markets worldwide.

Q2: Why do these events affect cryptocurrency markets?

A: Global economic health, interest rate policies, and inflation concerns directly impact investor risk appetite. These factors can lead investors to move capital between traditional assets and riskier assets like cryptocurrencies, causing price fluctuations.

Q3: Which events are most important for crypto traders this week?

A: Key events include FOMC member speeches (Bowman, Barr, Williams, Waller), U.S. October ADP Non-Farm Employment Change, and the Bank of England’s interest rate decision. These can provide crucial insights into monetary policy and economic strength.

Q4: How should crypto investors prepare for these announcements?

A: Investors should stay informed, understand the historical impact of such data, practice risk management by setting stop-loss orders, and consider their long-term investment strategy rather than reacting solely to short-term volatility.

Q5: What is the FOMC?

A: The FOMC, or Federal Open Market Committee, is the monetary policy-making body of the Federal Reserve System in the United States. Its decisions on interest rates and other policies have a significant impact on global financial markets.

Did you find this breakdown of the week’s key economic events helpful? Share this article with your fellow crypto enthusiasts on social media to help them stay informed and make smarter trading decisions!

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action.

This post Global Macroeconomic Calendar: Unmissable Events Shaping Crypto Markets This Week first appeared on BitcoinWorld.

You May Also Like

Highlights of Stanford HAI's 2025 Artificial Intelligence Index Report

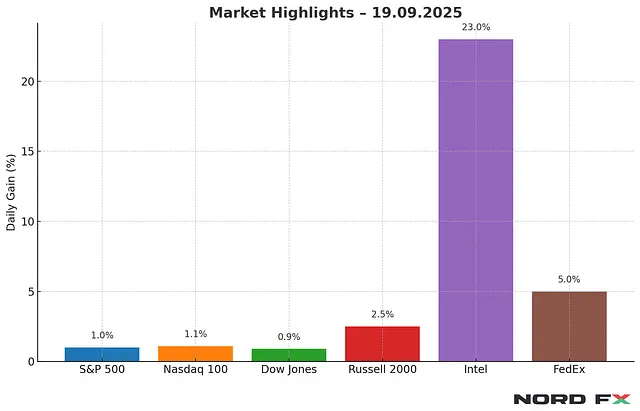

Morning Update — 19.09.2025