Bitcoin Hyper’s $24M Presale Surges as it Targets a Q1 2026 Release

Takeaways:

- Bitcoin Hyper’s ($HYPER) presale just reached the $24M milestone in just a few months after its start date

- Hyper promises a faster, cheaper, and more scalable Bitcoin ecosystem thanks to tools like SVM and the Canonical Bridge

- $HYPER’s starting price of $0.011500 is now at $0.013135 and it’s guaranteed to increase during the presale

- The project targets a Q1 2026 release date, which could be sooner depending on its presale performance

Bitcoin Hyper’s presale just reached $24M as the most promising Layer 2 for the Bitcoin network. The project aims to solve Bitcoin’s most pressing problem: its performance limitation.

Bitcoin Hyper ($HYPER) presents itself as the ideal solution to Bitcoin’s max cap of seven transactions per second (TPS), which is responsible for its high fees, hours-long confirmation times, and lack of scalability.

The presale started with an initial token price of $0.011500 and took $HYPER at today’s $0.013135, following multiple stage-based price increases, which will continue until release day.

Bitcoin Hyper targets a Q1 2026 release date ‘depending on market conditions and demand’, which means we could see a Q4 2025 launch as well.

But what is Bitcoin Hyper all about and should you invest? Let’s start at the beginning.

Bitcoin’s Most Glaring Problem

We already know that the Bitcoin network doesn’t live up to modern industry standards. The fees are too high, confirmation times can sometimes turn into hours, and the overall performance is sluggish.

Then we have the fee-based priority system, with the network prioritizing large transactions with high fees, leaving the smaller ones at the bottom of the queue line.

This is what impacts Bitcoin’s scalability the most and what explains why the vast majority of investors prefer Solana or Ethereum instead.

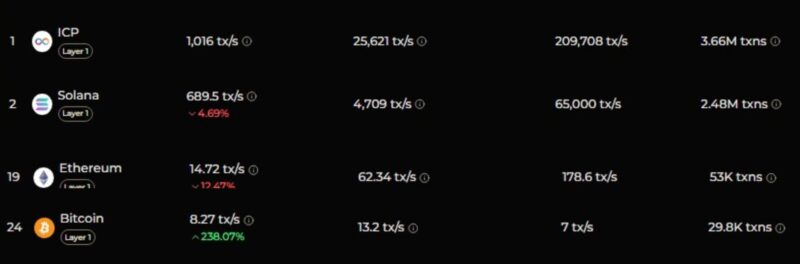

A quick look at the list of the fastest blockchains by TPS gives us a clear perspective: Bitcoin is on the 24th spot.

For reference, Solana is second, right after ICP, while Ethereum is 19th.

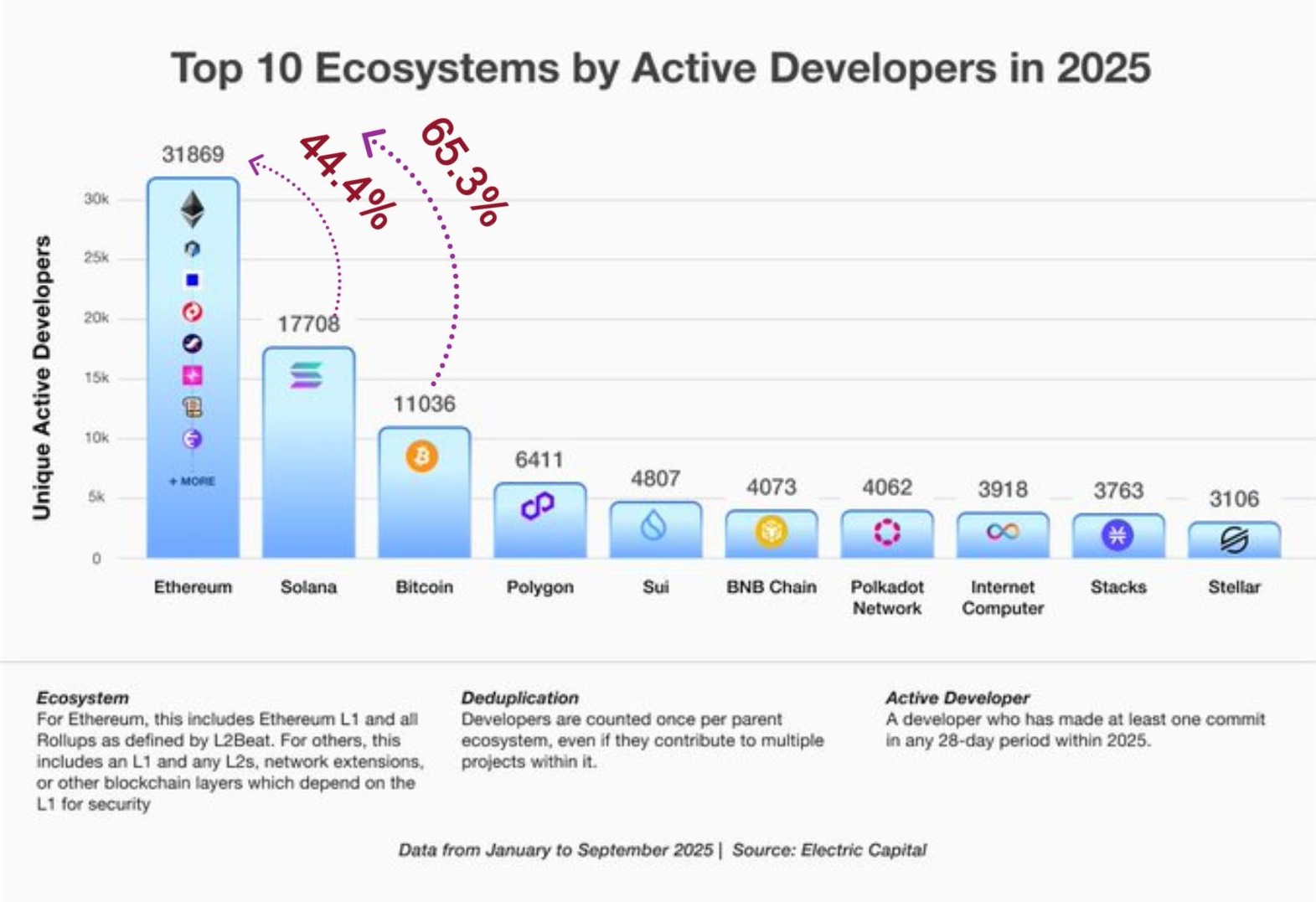

The fact that Ethereum is close to Bitcoin means nothing in this context. According to Ethereum Foundation data, Ethereum is the top pick for active devs in 2025 by a wide margin. The chain outweighs Solana and Bitcoin by 44.4% and 65.3% respectively.

The performance cap is a native Bitcoin feature and explains why the ecosystem keeps lagging behind all other blockchains in terms of adoption.

The Lightning Network was one of the first Layer 2 solutions attempting to circumvent this issue, but ultimately failed. The issues span from the unsustainable fees, to channel backup and recovery failures, and even security issues due to the Fraudulent Channel Scam.

And then we have Bitcoin Hyper.

How Bitcoin Hyper Plans to Solve the Problem

Hyper has one mission: circumvent Bitcoin’s TPS cap to allow for higher scalability, lower fees, and hyper-fast transactions.

This would eliminate the fee-based priority system, making the Bitcoin ecosystem a more feasible option for institutional investors like Visa, which processes thousands of transactions per second.

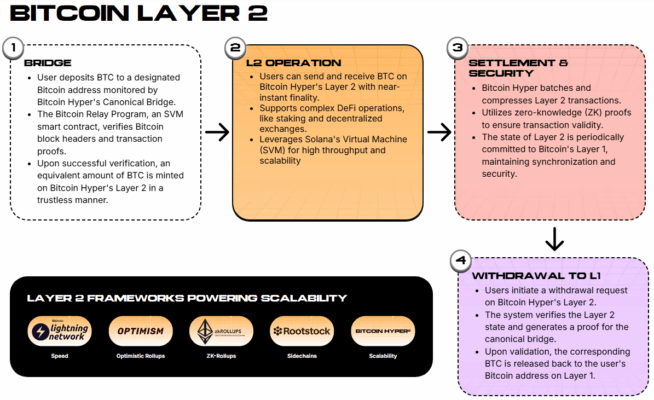

Hyper’s most impactful working tools are the Solana Virtual Machine (SVM) and the Canonical Bridge.

SVM aims to imbue the Bitcoin ecosystem with some of Solana’s chain performance by enabling the ultra-fast execution of DeFi apps and smart contracts.

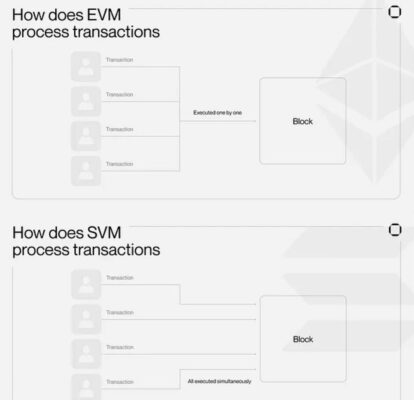

Unlike the Ethereum Virtual Machine (EVM), which processes transactions sequentially, on a single thread, SVM employs a multi-threaded approach, allowing it to process multiple transactions in parallel. The result: a TPS in the thousands.

The Canonical Bridge builds on that by connecting Bitcoin’s Layer 1 to Hyper’s Layer 2 and minting the users’ bitcoins into the Hyper layer. You can then either use your Bitcoin within the Hyper ecosystem with near-instant finality or withdraw them to the Bitcoin network at will.

On top of everything else, we have the Bitcoin Relay Program, which confirms incoming transactions nearly instantly, effectively circumventing Bitcoin’s 7-TPS cap.

Hyper also remains synchronized to Bitcoin’s Layer 1 permanently to retain the ecosystem’s responsiveness and security.

Long-term, Bitcoin Hyper aims to turn Bitcoin faster and more scalable without impacting its security or brand value. The goal is to make the Bitcoin ecosystem more feasible for institutional investors, putting it in direct competition with Solana and Ethereum.

Presale Numbers

Bitcoin Hyper’s ($HYPER) presale just surpassed the $24M mark with a token price of $0.013135 and it’s growing fast.

With a fixed total supply of 21B tokens and over 1B already in the staking pool, this is the perfect time to tune in. The project offers a dynamic staking APY of 49%, which will keep dropping as more heads join the staking pool.

According to the whitepaper, Hyper targets a Q1 2026 release, depending on ‘prevailing market conditions and demand’, which, based on the presale’s current performance, could bring the release date into 2025’s Q4.

If you want to invest today, your purchase options are $ETH, $USDT, $BNB, and credit card.

So, go to the official presale page and get your $HYPER while the presale still lasts.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Bitcoin Hyper’s $24M Presale Surges as it Targets a Q1 2026 Release appeared first on Coindoo.

You May Also Like

Ripple Takes Bold Steps into Corporate Finance with GTreasury Acquisition

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon